Create a roadmap for your financial success. We develop comprehensive strategic financial plans aligned with your business goals. Our planning process includes financial forecasting, budgeting, and risk assessment.

Strategic Financial Planning - Best CFO!

At Best CFO, we know that real business success doesn’t come from quick fixes. It comes from a financial strategy that helps your company grow and stay strong over time. Our financial experts in Brooklyn, New York help businesses create and follow financial strategies that match their goals and keep their finances healthy.

What is Strategic Financial Planning?

Strategic financial planning means thinking ahead and managing your business finances for the long term. It involves long-term planning and organization to make sure your company can handle changes, grow, and succeed. Instead of making short-term decisions, strategic financial guidance helps you build a plan that sets your business up for future success.

How Important Is Strategic Financial Management For Businesses?

Strategic financial management is about more than just balancing the budget. It’s a proactive way to manage your company’s money and resources. By planning ahead, your business can make smart financial decisions that support your long-term goals.

Here’s why it’s important:

- Better Resource Allocation

- Risk Management

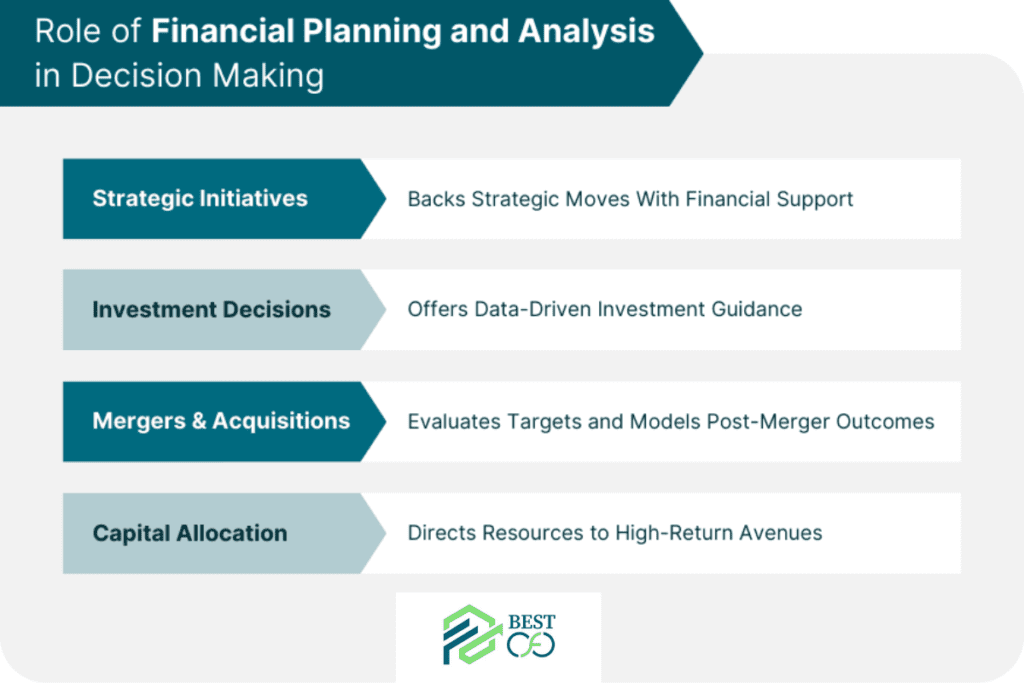

- Informed Decision-Making

Why Your Business Needs Financial Guidance

One key to long-term financial performance is establishing a strong financial strategy. Without one, businesses might overspend or underinvest, which can hurt profits and growth. Strategic financial planning focuses on these key areas:

- Defining clear financial goals that match your business objectives.

- Creating a realistic budget and predicting future financial performance.

- Finding and preparing for possible financial risks.

- Ensuring your business spends its money where it matters most.

- Regularly check your finances and adjust the plan as needed.

How Can the Best CFO Help Your Business Grow!

Our financial experts in U.S work closely with you to understand your goals, analyze your finances, and build a custom plan that fits your needs.

Here’s what you can expect from our services:

1. Financial Assessment

We start by reviewing your company’s financial health, including income, expenses, assets, and cash flow. This step helps us identify areas for improvement and growth.

2. Custom Financial Strategy

Based on our assessment, we create a financial strategy tailored to your long-term goals. Whether you want to grow your business, improve profits, or reduce debt, we’ll create a plan that fits your unique needs.

3. Setting Long-Term Financial Goals

One key to long-term financial performance is to establish clear financial goals. We help you define those goals and create a plan to achieve them. A long-term financial goal usually involves setting priorities and budgeting carefully.

4. Budgeting and Cash Flow Management

A good budget is the backbone of any financial plan. We’ll help you create a budget that ensures your business spends its money wisely. We also manage your cash flow, making sure you have enough money to meet your obligations and invest in opportunities.

5. Risk Management

Every business faces risks, from market changes to unexpected expenses. We’ll help you identify potential financial risks and develop strategies to protect your business.

6. Ongoing Monitoring

Strategic financial planning isn’t a one-time job. We’ll continuously monitor your finances and make adjustments as needed to keep your business on track for success.

Benefits of Strategic Financial Planning in Brooklyn, New York!

Working with the best financial experts offers several key benefits:

1. Better Financial Performance

A solid financial plan improves profits, reduces waste, and helps your business grow.

2. Increased Flexibility

Strategic financial plans help your business stay flexible, allowing you to respond quickly to changes or new opportunities.

3. Smarter Decision-Making

With a clear financial plan in place, you can make decisions that support your long-term goals.

4. Reduced Risk

By planning for risks in advance, we help protect your business from unexpected financial challenges.

5. Long-Term Success

Strategic financial consulting is all about preparing for long-term success. Our plans help you build a strong foundation for the future.

Get Started Today!

Ready to take control of your company’s financial future? Contact Best CFO today to learn more about how our top-notch services in New York and overall US can help your business thrive.

Frequently Asked Questions - Strategic Financial Planning

- How does strategic financial management benefit my business?

Strategic financial management helps your business make smart financial decisions. It reduces risks, improves profits, and aligns your financial actions with long-term business goals.

- 2. How do long-term financial goals differ from short-term financial goals?

Long-term financial goals, such as expanding your business or paying off debt, usually take years to achieve. Short-term goals focus on immediate needs, like managing monthly expenses, and can be achieved within a year.

- 3. What is the process for creating a financial strategy with Best CFO?

We begin by assessing your financial situation and understanding your business goals. Then, we create a custom financial strategy that includes budgeting, risk management, and ongoing monitoring to keep your business aligned with its long-term objectives.

- 4. What role does the mission statement play in the planning process?

Your mission statement defines your company’s purpose and direction. It guides the financial planning process to make sure that the financial strategy aligns with your company’s overall goals.

- 5. What are three questions financial managers ask when considering long-term financing?

Financial managers should ask these questions: What are the costs of the financing options? How will this financing impact the company’s cash flow and overall financial health? Does this financing align with our long-term financial goals?

- 6. How often should I review and update my financial plan?

It’s important to review your financial plan at least once a year or when your business experiences major changes, such as market shifts, new goals, or unexpected financial challenges.

- 7. How can strategic financial planning help manage risks?

Strategic financial planning helps spot potential risks early. By identifying risks and creating backup plans, businesses can prepare for challenges and reduce their impact on long-term financial success.

- 8. What is the difference between a financial plan and a financial strategy?

A financial plan outlines your current finances and sets specific future goals. A financial strategy is the approach you use to meet those goals. Both work together to guide your business toward financial success.

Access skilled financial expertise without full-time costs. Best CFO offers fractional CFO services in New York and Beyond, providing part-time CFO support tailored to your business needs. Our professionals have over a decade of expertise to deliver strategic financial guidance, improve cash flow, and optimize financial operations.

Our power of choice is untrammelled and when nothing prevents our being able to do what we like best, every pleasure is to be welcomed and every pain avoided. But in certain circumstances and owing to the claims of duty.

Background Checks

These cases are perfectly simple and easy to distinguish. In a free hour when our power.

Profile Assessments

Indignation and men who are so beguiled and demoralized by the charms blinded.

Position Description

Trouble that are bound to ensue and equal blame belongs those who fail in their duty.

HR Functions

Nothing prevents our being able to do what we like best every pleasure is to be welcomed & every pain avoided certain circumstances.

Equal blame belongs to those who fail in their duty through weakness same duty.

Business it will frequently occur that pleasures have to be repudiated.

Holds in these matter to this principle selection he rejects pleasures to secure.

Service Benefits

- Who is Qetus?

Nor again is there anyone who loves or pursues or desires to obtain pain itself because it is pains but because occasionally circumstances occurs great pleasure take a trivial of us.

- What recruitment services do you offer?

Serenity Is Multi-Faceted Blockchain Based Ecosystem, Energy Retailer For The People, Focusing On The Promotion Of Sustainable Living, Renewable Energy Production And Smart Energy Grid Utility Services.

- How can I register a job?

Serenity Is Multi-Faceted Blockchain Based Ecosystem, Energy Retailer For The People, Focusing On The Promotion Of Sustainable Living, Renewable Energy Production And Smart Energy Grid Utility Services.

Demos

Demos  Colors

Colors  Docs

Docs  Support

Support