Table of Contents

Sales Tax Certification Services is a type of tax certificate to sell goods, sales tax is applied on the end-purchase of a good, service or product. In United States of America, sales tax certificate is also known by different names in different states, which include:

- Re-seller License,

- Sales Tax ID Number,

- Re-seller Permit,

- Sales Tax Vendor Registration,

- Sales Tax Vendor ID Number,

- Certificate Of Authority,

- Sales Tax Exemption Certificate,

- Sales Tax Registration,

- Re-seller Tax ID,

- Sales Tax Permit,

- Re-seller Certificate or,

- Tax-Exempt Certificate.

Our State Representation Service:

Sales tax is basically a specific proportion of the net price tag of a good or service that is being purchased. Sales tax is applicable on all retail sales, rentals and leases of the majority of products and on some taxable services. However, the products that are purchased for re-sale or for further processing are free from sales tax. A sales tax certificate provides exemption to the business owners from sales tax paid. To obtain a reseller permit in USA is made easier with Black Ink products and services. You can get sales tax ID in New York, New Jersey, Texas, Arkansas, Massachusetts, Vermont, Connecticut, and in other states and cities of U.S.A. with the expertise of our professional staff.

As a new business owner in USA, the sales tax responsibilities vary on the basis of certain criteria including type of organization, start-up business or existing business take-over etc. Sales tax is estimated on state level, along with country and municipal levels. You need to make your sales tax payments in USA on the basis of your sales as well as the laws & regulations of your state. Sales tax is basically imposed on the consumers as it is applied on the end-purchase. On the other hand, the re-sellers are exempted from sales tax burden, as sales tax is levied on the use of the goods/ services/ products.

Sales Tax Vendor Registration:

Service to get Certificate of Authority or Sales Tax Certification Services required by those businesses in USA that sell tangible personal property or taxable services in New York State, etc. Sales tax certificate gives the authority to the business owners to collect sales tax on taxable sales. New York State Department of Taxation and Finance (DTF) is responsible to provide sales tax certificate and Black Ink has made it all easier for its customers. Book an appointment with us to get sales tax certificate for your business in New York, USA and save a proportion on your sales and use taxes in United States. Certificate of Authority also helps in obtaining sales tax exemption certificates in USA that is also a unique feature of our services for a better financial planning of your business in New York.

What is Sales tax ID number in USA?

Sales Tax Exemption Certificate or Sales Tax ID Number is a legal document that is issued in the form of a certificate by the specific state of USA in which your business is operating. Sales Tax Certification, also known as Certificate of Authority, provides the authority to the business owners to collect the required amount of sales and use taxes from the consumers. Plus, USA sales tax certification services help the business owners to release necessary sales tax exemption documents as well as re-sale certificates that are used for purchasing inventory.

When should I get sales tax certificate in USA:

It is mandatory as a business owner to obtain a sales tax ID certificate from the tax department, get our Sales Tax Certification Services for your specific state to get registered as a sales tax vendor. After obtaining sales tax certificate for your business, you can make taxable sales. Substantial penalties may be imposed to your business if you start selling taxable items before receiving the sales tax exemption certificate from your state in USA.

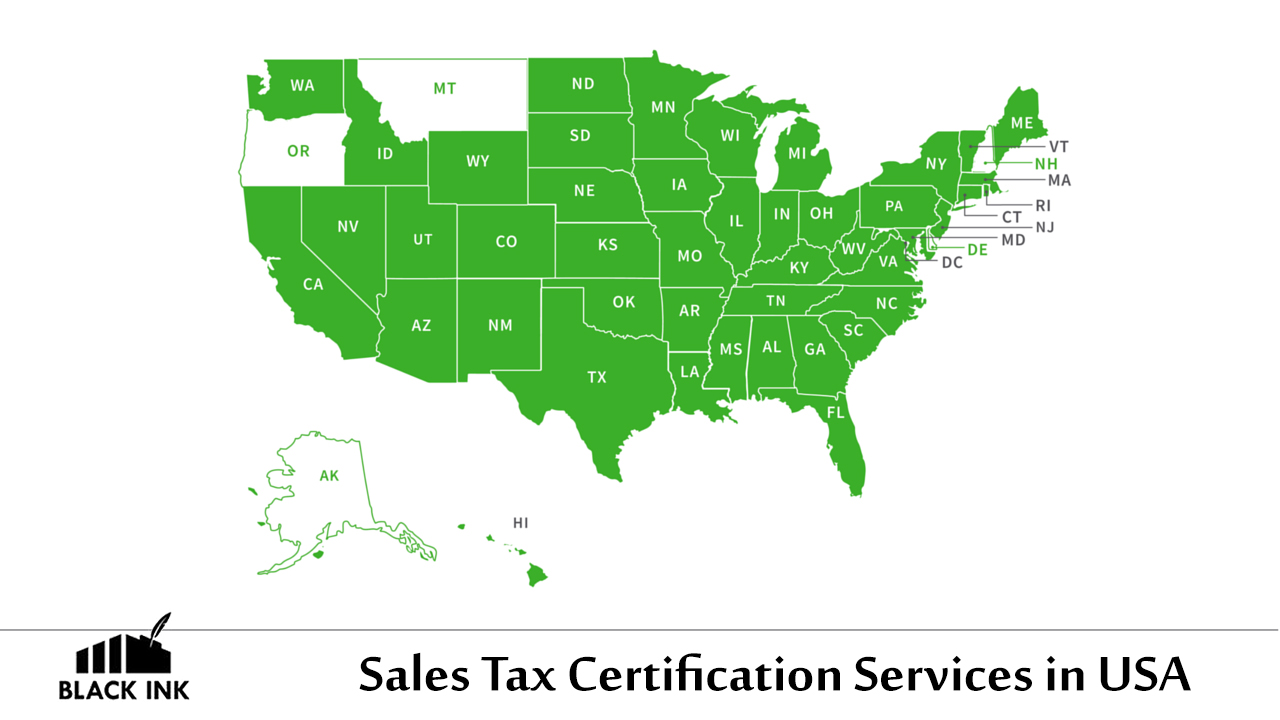

Sales tax exempted states in USA:

There are total five states in USA that are free from sales tax. These include:

- Alaska

- Delaware

- Montana

- New Hampshire

- Oregon

Why should I get USA sales tax certificate?

To sell any taxable product or to provide any taxable service in any state of USA (except the five that we have already mentioned above as sales-tax exempted states in USA), business owners are required to collect sales tax from customers. For this purpose, the particular Sales Tax ID Number of your business allows the business owners to collect sales tax on your taxable sales, so we are providing Sales Tax Certification Services. Once you get your Sales Tax ID Number Certificate in USA, the state provides you the authority to collect sales tax even if you have never started commencement of your business or never made any sale. Therefore, it is vital for the business holders to file the sales tax returns timely so that they remain protected from the penalties of not filing sales and use tax in USA, even if the business owners do not have any taxable sales during the reporting period of sales tax returns.

How does a sales tax certificate work?

On the basis of the state where you are running your business corporation as well as the types of products that you purchase, you can save up to 10% on state and local tax returns. Save money on taxes by not paying sales taxes on certain products and this can only be done by getting Sales Tax Certification Services and other related documents in New York State and other states of USA. Products for re-sales or the items that you buy to make a product for re-sales are free from sales tax for vendors. Apply for your sales tax certificate from your state to enjoy savings on sales taxes.

Keep in mind that a sales tax certificate is meant for exemption from sales tax paid and it is not concerned with the exemption from that sales tax which you collect from your consumers. We provide sales tax certification services all over in USA, right from the registration process of sales tax certificate till the preparation of sales tax returns in USA.

How to get eligible for sales tax certificate:

To qualify for sales tax certificate in any state of USA, from New York to New Jersey, and to get exempted from sales tax, it is necessary for the business owners that they must not use the items that they purchase in their normal business course. For e.g., sales tax exemption cannot be requested on the purchase of a copy paper because it will be used in your own business settings. Furthermore, majority of the states have limitations on the type of services and products that can be bought without paying sales tax to the government so you must get Sales Tax Certification Services for any type of business in NY, USA.

Categories of Certificate of Authority in USA:

For sales tax purpose, two types of sales tax certificates are issued by the tax department of USA that include Regular Certificate of Authority & Temporary Certificate of Authority. The expected duration of your business activities and operations decide the need of the type of Certificate of Authority. Application procedure and forms are similar for both types of sales tax certificates with a minor difference that a beginning and ending date is required in case of temporary sales & use tax certificate. Check the below points for further illustration:

1. Regular Certificate of Authority:

A regular sales tax certificate is required if your business is conducted regularly and you make taxable sales regularly from your shop, store, office, home, stand or any other business facility, get Sales Tax Certification Services now! Whether you own the facility or you are renting it out, does not matter. Furthermore, if your sales is confined to an occasional event or isolated platform, for e.g., in any circus, flea market, craft show, sports event, or entertainment event etc, you are required to apply for a regular Certificate of Authority.

2. Temporary Certificate of Authority:

If you business is expected to make taxable sales in New York State, USA for not more than two consecutive sales tax quarters in any 12-month period, then you can apply for a temporary sales tax certificate in USA. You must consider sales tax quarters for determining your eligibility criteria that are designated from March 1 through May 31, June 1 through August 31, September 1 through November 30, and December 1 through February 28 (February 29 in a leap year). It is mandatory for the business owners to specify the beginning and ending date of their business operations for requesting a temporary Certificate of Authority. Once you get temporary sales tax certificate, you can collect tax to conduct your business only during those specified dates.

New Sales tax certificate in USA:

If you desire to change the organization structure of your business, for e.g. from Sole Proprietorship to LLC, Corporation or Partnership, the new organization is required to must register as a new sales vendor in USA, get Sales Tax Certification Services. It is also mandatory for the new organizational structure to obtain its new reseller certificate before beginning any business operation. Furthermore, a final return is also required to be filed for the existing business prior to surrendering the previous sales tax business certificate. For buying an existing business or for taking over the ownership of family business, an existing sales tax certificate cannot be transferred and you have to apply for a new Certificate of Authority from the concerned department. We are also offering service to get FEIN tax ID for businesses in NY, USA for all small and medium corporations.

Duplicate sales tax certificate service:

If you have already registered for sales tax with the Tax Department of USA but you need a duplicate copy of your Certificate of Authority, Black Ink can help you in this regard. If the original sales tax certificate of your business is destroyed, misplaced or damaged, you can contact us to get the duplicate one.

Types of sales tax certificate in USA:

There are two types of sales tax certificate in USA that include Reseller Certificate & Exemption Certificate. Both of these sales tax certificates are treated differently in various states of USA, for e.g. California. Therefore, we are elaborating both types so that our clients can get an idea about these:

1. Exemption certificate:

A sales tax exemption certificate provides the business owners with the exemption from sales tax for a specific type of product or service. For instance, the purchase of computer for re-sale is exempted in some states from sales tax.

2. Reseller certificate:

With this certificate, the business owners can purchase certain products as wholesale bulk, which are then re-sold at retail stores. The purchase of such products qualifies for reseller’s certificate, get our Sales Tax Certification Services now!

Sales tax certificates for non-profit businesses:

Non-profit organizations are considered as tax-exempt organizations by the IRS in USA. Must note that this tax-exemption is limited to the income taxes only. Non-profits still have to pay sales taxes to state and local government in USA where these are registered.

Where should I display sales tax certificate:

It is necessary for the business owners to display their Certificate of Authority at their business place. If you do not own any specific business place or location, then it is necessary to attach your sales tax certificate to your car, truck, van, wagon, stand, vehicle or any other business operation facility from where you are conducting the collection of sales tax. Any failure to properly display sales tax certificate can cause a $50 penalty to the business owners in USA, you can get Sales Tax Certification Services by us by filling out this form.

How do I know what is taxable in USA:

Almost every tangible personal property transferred for value is taxable in USA. If you are running your business in United States, you must be certified, hence we are providing Sales Tax Certification Services for majority of the goods, products, wares as well as merchandise are taxable. The property which is purchased for rent or lease is also taxable in USA. Furthermore, those specific services that are related to the sale of tangible personal property may also be taxable in the US. If the repair/reconditioning or installation service is separately stated on the invoice, then it will not be considered taxable. Similarly, most of the food ingredients purchases of uncooked or raw food are not considered taxable. Check the list below to get acquainted with the list of taxable items in USA for sales tax.

Tangible Personal Property for sales tax:

Retail sales of tangible personal:

- Furniture, lighting fixtures and appliances

- Computers and PRE-written (canned/off-the-shelf/standard) computer software.

- Machinery in addition to equipment, parts, tools, as well as supplies.

- Motor vehicles.

- Fuels (for example, motor fuel, diesel motor fuel, and kero-jet fuel).

- Yachts and boats.

- Candy plus confections;.

- Cigarettes as well as tobacco products.

- Bottled water, soda, and beer.

- Jewelry items.

- Toiletries and cosmetics.

- Artistic items (for example, sketches, paintings, and photographs)

- Coins and other monetary items, when purchased for purposes except for use as a medium of exchange.

- Building materials.

- Animals, trees, shrubs, plants, and seeds.

- Prepaid telephone calling cards.

Sales of exclusively enumerated services:

- Offering some specific information about Sales Tax Certification Services.

- Personal property furnished by a consumer who did not undergo the purchase process of the tangible personal property for resale;

- Processing, fabricating, assembling, printing or imprinting tangible personal property;

- Installation, maintenance, service, or repair of tangible personal property that is not held for sale by the purchaser of the service in the regular course of business.

- Renting safe deposit boxes, vaults, as well as similar storage facilities

- Storing tangible personal property that is not being held for sale

- Maintenance, service, or repair of real property both inside and outside buildings.

- Protective or detective services.

- Interior decorating as well as designing;

- Providing parking, garaging, or storing services for motor vehicles

- Entertainment or information services provided by means of telephone or telegraph.

Additional Taxable Items include:

- Sales of telephony and telegraphy including telephone answering services, cellular telephone services, and facsimile transmission services).

- Gas, refrigeration, electricity, and steam service.

- Food and drink for on premises consumption (for example, when sold by restaurants and taverns).

- Heated food and sandwiches sales.

- Rent for occupancy of hotel or motel rooms (including bed and breakfasts, guest houses, boarding houses, etc).

- Admission charges to places of amusement, other than live dramatic or musical arts performances, participatory sporting events, motion picture theaters, or live circus performances.

- Dues, including initiation fees, paid to social or athletic clubs when the dues are more than $10 per year.

- Charges of a roof garden, cabaret or other similar places.

Are you ready to order your sales tax ID in USA? Black Ink can professionally prepare Sales Tax Certification Services in New York, New Jersey and other states of the US. Simply make an inquiry with us to get your sales tax certificate for business in USA. If you need help and if you have any queries regarding different types of sales tax certificates and sales tax forms in New York state, our representative can help you directly with a single click. We are also providing sales tax preparation & filing services in NY, USA. Stay in touch with Black Ink via our blog.

GET FREE QUOTE FOR ALL OF OUR SERVICES

Black Ink will send you a free analysis of your current state and what would be the cost of managing either a separate accounting and bookkeeping services or a complete solution across New York, USA. Do get in touch and we will be happy to consult you with our bookkeeping services in NY, New York, USA.